Lehi, Utah - July 17, 2025

At the heart of Utah’s booming startup scene, Third Thursday @ Three—a monthly pitch event, founded in 2023 by venture advisor and startup scout Ray Smithson, enabled by Kinect Capital, and hosted by Kiln Lehi—is fast becoming a launchpad for the state’s next wave of innovation. From medtech and marketplaces to AI-driven venture tools, the founders at this week’s event delivered raw, passionate pitches with real stakes behind them. Here’s a look at who took the stage:

Ollin Ventures – Founded by Tom Wilkinson

Tom Wilkinson, a serial entrepreneur turned venture fund manager, kicked things off by sharing his journey from BYU student to startup backer. “My plan was to get a degree, work for someone until I was 40, then finally start my own thing,” he said. That changed when a mentor and professor, Corbin Church—lifelong entrepreneur, angel investor, and founder of iHub—told him, “Tom, that’s the dumbest thing I’ve ever heard. That changed everything for me,” Wilkinson shared.

Now he runs Ollin Ventures, a fund focused on backing early-stage BYU startups. “Of the 65 unicorns in Utah, 39 came from BYU,” he noted. “We see them first. We back them early.” Ollin writes checks between $250K–$750K once companies show traction—usually around $100K–$200K in revenue.

Operating out of iHub in Provo, an incubator that houses over 200 startups, the firm prides itself on being hands-on. “We’re not just writing checks—we’re in the mud with founders,” he said. The fund has already recorded six markups and claims top-decile performance according to Carta. “If you invest now, you’re stepping into a fund that’s already growing in value.”

Freyya – Co-founded by Gabi Niederauer and Stefan Niederauer

Next up was Freyya, a company tackling pelvic floor disorders with a wearable device that offers women accessible, private, and effective therapy. “One in four women suffers from pelvic floor dysfunction,” said Stefan. “It’s not just uncomfortable. Left untreated, it becomes one of the top reasons women end up in long-term care.” Freyya’s device is about the size of a tampon and tracks both pelvic floor force and abdominal pressure. “Other tools only work lying down. Our solution works during real-life movement, which is when symptoms actually happen,” he added. Co-founder Gabi emphasized the personal mission behind the product: “The goal is to bring therapy into the home. It’s personal. It’s overdue.”

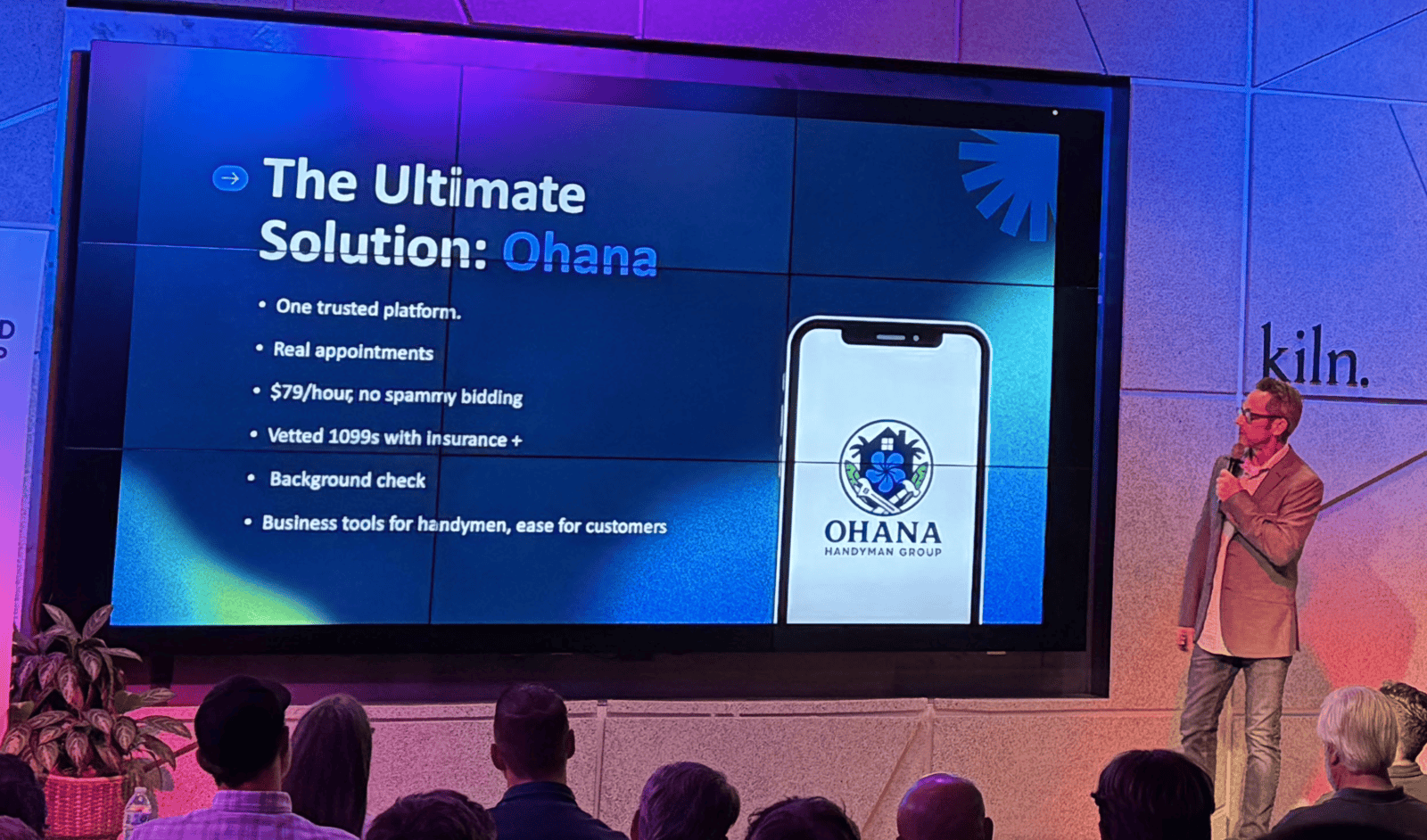

Ohana Handyman Group – Founded by Joshua Ezell

Joshua Ezell took the stage with a relatable mission: fixing the broken handyman industry—starting with a platform that just works. “Just because you’re a great pie maker doesn’t mean you should own a pie shop,” he said. “Handymen are great at fixing homes, not juggling calls, marketing, and billing.” He built Ohana Handyman Group for people like Judy—a customer who once waited all morning for a no-show contractor. Now, she can book in minutes, view a technician’s bio and photo, and know exactly who’s coming. “I made this out of my office. I’ve helped thousands of people in Phoenix. And I’m just getting started.”

IQ500 – Founded by David Loucks

Rounding out the lineup was IQ500, founded by David Loucks, a veteran of venture finance. He calls the platform “the Schwab meets Bloomberg Terminal for venture capital.” IQ500 uses 300,000 AI algorithms to map the entire global venture capital ecosystem in real time—covering startups, investors, and LPs. “It’s one login that replaces CRMs, spreadsheets, LinkedIn searches, and cold emails,” said Loucks. For founders, IQ500 offers predictive analytics with 96% statistical certainty on who their next likely investor is. “We reduce prep time from five months to five minutes. And we can cut over $1 million in cost out of the process.” The platform serves both founders and investors. “If you’re a VC, your biggest risk is financing gaps in your portfolio. We help you spot that early,” Loucks explained. “If you’re a founder, we help you raise smarter, faster, and cheaper.” With $3.5M invested and a backlog of 60 paying subscribers, IQ500 is already live. “Our break-even is 100 subscribers,” he said. “We’re almost there.” As for the long-term vision: “Outcomes, not just data. We’re not here to just track the venture market—we’re here to fix it.”

Utah's Startup Energy Is More Than Hype

Utah’s startup scene isn’t just active—it’s intentional. The founders on stage weren’t simply pitching; they were solving real problems with personal stakes, sharp strategies, and a clear sense of purpose. From women’s health to service marketplaces to the mechanics of venture capital, these founders are building with urgency and meaning. This isn’t just a collection of startups—Third Thursday @ Three a movement with momentum.

“Founders are the modern-day pioneers—venturing into the unknown and forging ahead when the path is tough," said Ray Smithson, Founder of Third Thursday @ Three. "It’s endlessly inspiring to be part of that journey. Utah’s deep pioneer roots make it a natural home for innovation.”

This Third Thursday also featured outstanding individuals in the Utah ecosystem: Shaun Wilson (CBVault), Tomi Smith (Keiretsu Forum Northwest & Rockies), Alexis Nelson (Silicon Slopes IP), Tim Cooley (Startup State from the Governor’s Office), and three-time Olympian and 2002 Olympic silver medalist Bill Schuffenhauer, breaking a 46-year medal drought for the US in bobsled.

"One fun fact—CBVault has been helping Utah entrepreneurs since the 1890s," noted Smithson. "And Keiretsu is one of the largest global angel networks, with over 3,500 angels and family offices around the world."

The Third Thursday @ Three series is powered by Kinect Capital, a nonprofit that’s helped Utah founders raise and exit over $30 billion across the past 42 years. Its biggest event of the year is coming up on September 17—the 42nd Annual Kinect Capital Investors Choice Conference—at which Paul Ahlstrom will be honored with an award and speak on a panel. It will also feature multiple Olympians and ecosystem leaders—including Steve Chen, cofounder of YouTube.

To learn more about Third Thursday @ Three, reach out to Ray Smithson at thirdthursdayatthree.com.

To register for the 42nd Annual Kinect Capital Investors Choice conference, click here.