Today Sorenson Ventures (Salt Lake City) announced it has raised $150 million for its second fund, Sorenson Ventures II. The raise was oversubscribed and reached its intended hard cap of $150 million. The new fund includes limited partners from foundations, endowments, fund of funds, a reinsurance company, a pension fund, and corporate, family office, and experienced individual technology investors. The new fund will focus on pre-revenue and early revenue B2B software companies.

Founded in 2017 by longtime venture capitalists Ken Elefant and Rob Rueckert, who met through the Kauffman Fellows program, Sorenson Ventures has invested in over 30 early-stage companies including Socure, an identity verification platform that recently raised $450 million at a $4.5 billion valuation; CyCognito, a cyber security startup that in December raised a $100 million Series C at an $850 million valuation; and MX, the Lehi, UT-based data-driven finance solution that in 2021 raised $300 million at a $1.9 billion valuation. Other local investments include GuideCX, Workfront, Podium, BambooHR, Pluralsight, HealthFront, Omniture, Route, and Via, one of the early investments from the new second fund.

Founded in 2017 by longtime venture capitalists Ken Elefant and Rob Rueckert, who met through the Kauffman Fellows program, Sorenson Ventures has invested in over 30 early-stage companies including Socure, an identity verification platform that recently raised $450 million at a $4.5 billion valuation; CyCognito, a cyber security startup that in December raised a $100 million Series C at an $850 million valuation; and MX, the Lehi, UT-based data-driven finance solution that in 2021 raised $300 million at a $1.9 billion valuation. Other local investments include GuideCX, Workfront, Podium, BambooHR, Pluralsight, HealthFront, Omniture, Route, and Via, one of the early investments from the new second fund.

The firm has already had several exits from its first fund, Sorenson Ventures I, including Bridgecrew (acquired by Palo Alto Networks), CloudKnox (acquired by Microsoft), and Openpath (acquired by Motorola).

TechBuzz sat down with Rob Rueckert, Founding Partner, who described the second fund, like the first fund, as a sector focused fund, that sector being B2B. "We are not a broad-based fund, not a geography fund. We are one hundred percent focused on B2B software," says Rueckert. "That's where my background and Ken's background has always been. And within B2B, we invest in security and infrastructure firms: databases, data infrastructure, AI/ML, and some application areas. And those investments could be anywhere: Florida, Canada, Utah."

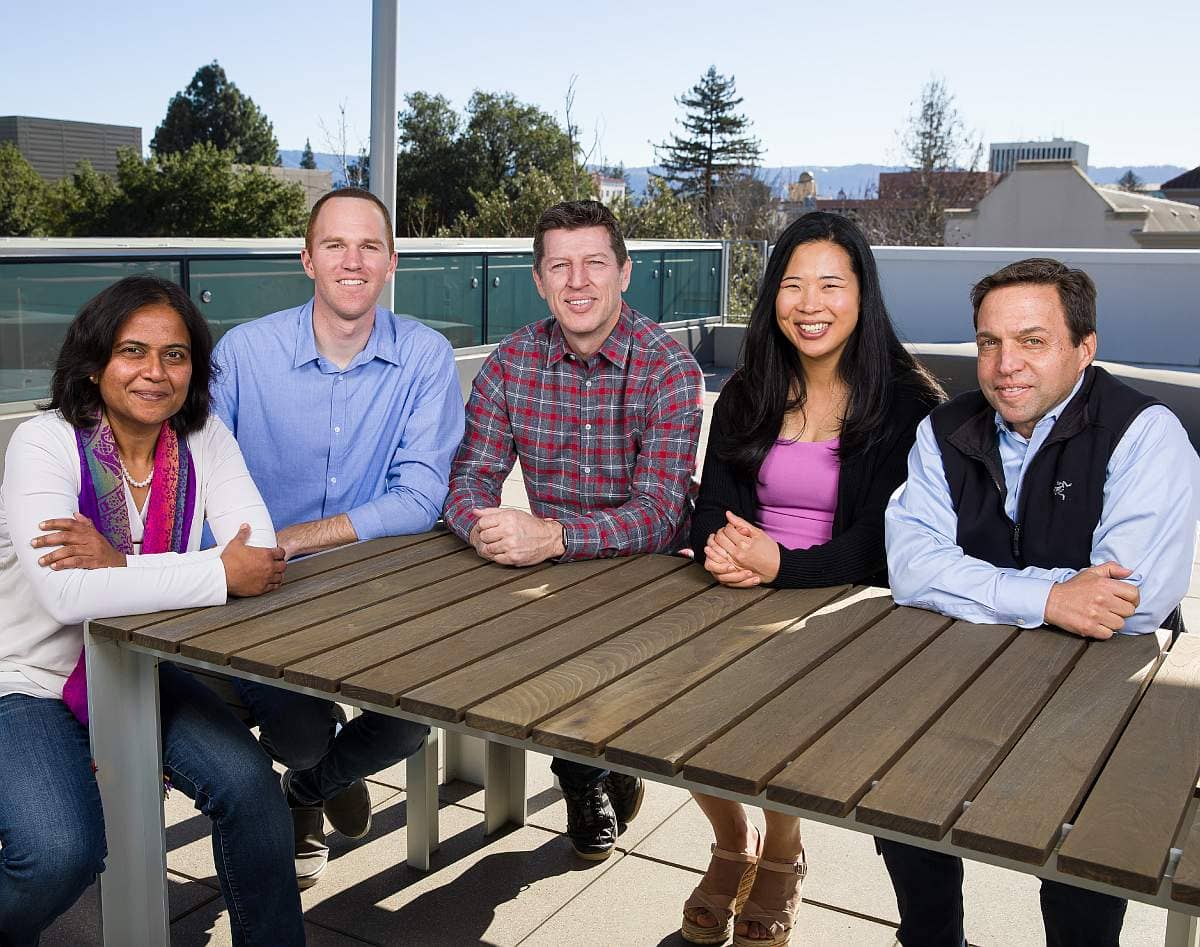

With decades of operational and investing experience in enterprise software and security startups, the Sorenson Ventures team focuses on investing in early-stage companies in sectors that include developer tools, machine learning applications, data infrastructure, management platforms, and security companies protecting new attack vectors. The fund typically invests in companies at the Seed or Series A stages. The new fund has three partners: Rueckert and Elefant, and more recently Vidya Raman whose promotion to partner was announced on February 14, 2022. In addition, Eric Hilton, Michelle Moon, Bert Roberts, and Tony Spinelli manage the fund.

With decades of operational and investing experience in enterprise software and security startups, the Sorenson Ventures team focuses on investing in early-stage companies in sectors that include developer tools, machine learning applications, data infrastructure, management platforms, and security companies protecting new attack vectors. The fund typically invests in companies at the Seed or Series A stages. The new fund has three partners: Rueckert and Elefant, and more recently Vidya Raman whose promotion to partner was announced on February 14, 2022. In addition, Eric Hilton, Michelle Moon, Bert Roberts, and Tony Spinelli manage the fund.

“We are product-first investors who partner with entrepreneurs using their engineering vision to change markets,” says Rueckert. “We believe we bring something different to the table, and as such, we’ve been fortunate to syndicate with firms such as Lightspeed, Battery Ventures, Emergence, Accel, and General Catalyst, among many other high-quality firms. We’re going to continue to invest in founders who are building innovative products that have impressive intellectual property and who have the vision to execute.”

Sorenson Ventures is a partner firm of Sorenson Capital, a growth equity firm focused on enterprise software and security investments. Sorenson Capital was founded in 2002, and to date (end of 2021) is managing $1.5 billion in assets. While each firm raises its own funds and invests independently, the teams collaborate on investment thesis, go-to-market analysis, and building extensive customer, partner, and expert networks that they can leverage for their portfolio companies.

“What sets Sorenson apart is our manageable fund size and focused investment thesis,” says Elefant, Founding Partner. “We’ve intentionally structured our firm to allow us to engage deeply as we collaborate with founders and support our portfolio companies. We roll up our sleeves to help portfolio companies identify and validate product-market fit and optimize go-to-market strategies. We don’t just provide investment capital. We seek to become a true partner to the companies in which we invest.”

“What sets Sorenson apart is our manageable fund size and focused investment thesis,” says Elefant, Founding Partner. “We’ve intentionally structured our firm to allow us to engage deeply as we collaborate with founders and support our portfolio companies. We roll up our sleeves to help portfolio companies identify and validate product-market fit and optimize go-to-market strategies. We don’t just provide investment capital. We seek to become a true partner to the companies in which we invest.”

Rueckert sees Utah as an emerging geography for infrastructure and security software companies. "Ten or fifteen years ago, Utah was more of an application software geography, but that has been evolving rapidly. Utah is home to lot more infrastructure and security companies now, but there's still room for us to grow in this area. I would say the hotspots for security software are first Israel and the Bay Area as a close second. But you're starting to see Utah go beyond the application software and go deeper into deep tech, solving hard problems like cyber and infrastructure, which is exciting to see."