Night Capital and K5 Tokyo Black lead seed round with support from Penny Jar Capital, Background VC, Mintaka VC, and top startup operators

Lehi, Utah — October 9, 2025

Early-stage startups often struggle with finance. Spreadsheets break, assumptions go untested, and fundraising decks leave investors unconvinced. For most founders, managing finance is a constant headache—critical decisions are slowed, plans are ignored, and mistakes are repeated.

Parallel is tackling that problem head-on. Today, the startup announced $2.4 million in seed funding to launch its AI-native finance platform paired with a network of dedicated fractional CFOs. The round was led by Night Capital (Austin) and K5 Tokyo Black (San Francisco), with participation from Penny Jar Capital (San Francisco), Background VC (San Francisco), Mintaka VC (Belmont, CA), and Path Ventures (Menlo Park).

Strategic operators, many of them local, including Jeron Paul (Spiff), Jared Rodman (Weave), Alex Bean (Divvy) and Colin Zima (Omni), also invested in the round.

The capital will accelerate product development, expand the CFO network, and deepen integrations that keep financial models live, auditable, and decision-ready.

“Founders don’t need another spreadsheet—they need an always-current plan and a partner who can reason through tradeoffs,” said Renato Villanueva, Parallel Co-founder and CEO. “Parallel combines AI-powered finance agents that do the work with CFO judgment that stands behind the plan, so teams can move faster and with confidence—from hiring to fundraising.”

Solving the Startup Finance Problem

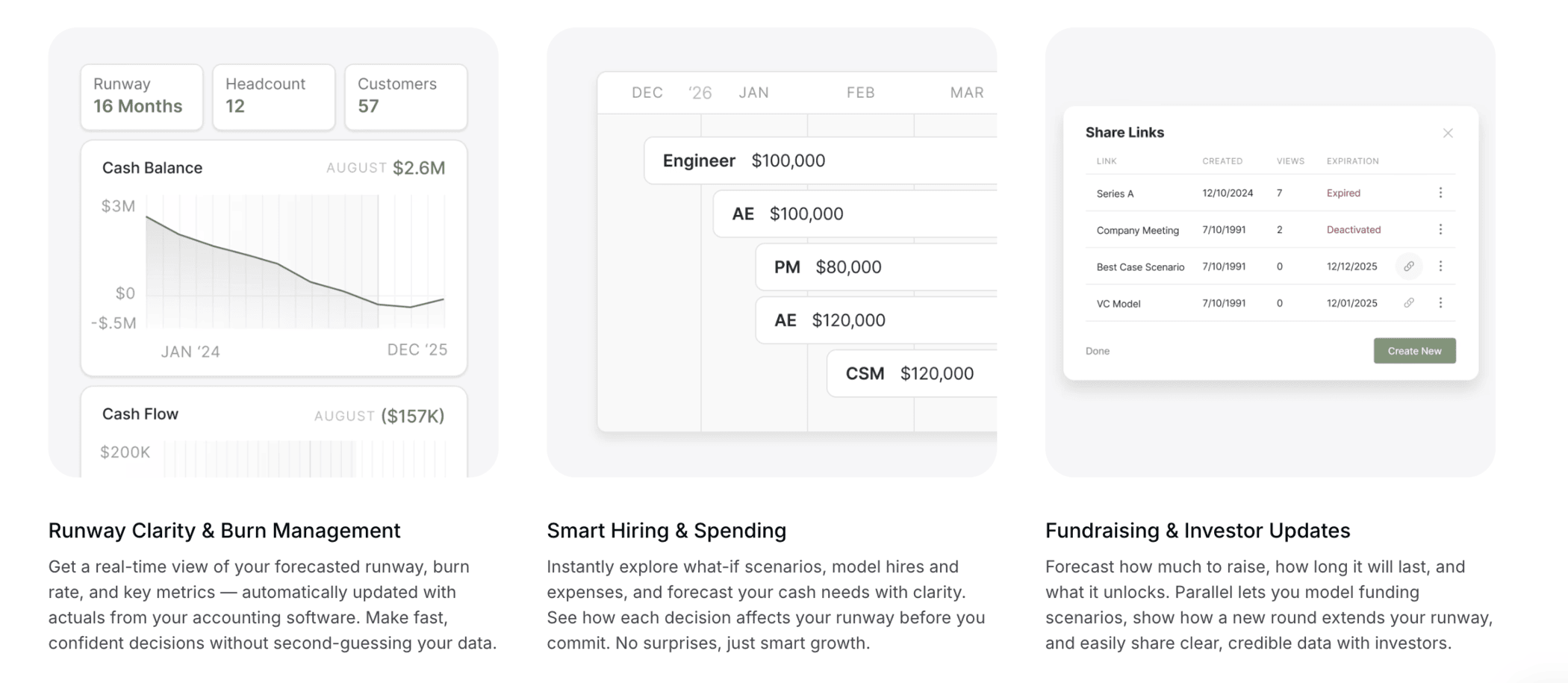

Parallel provides a complete software-plus-service solution designed for the unique needs of early-stage companies:

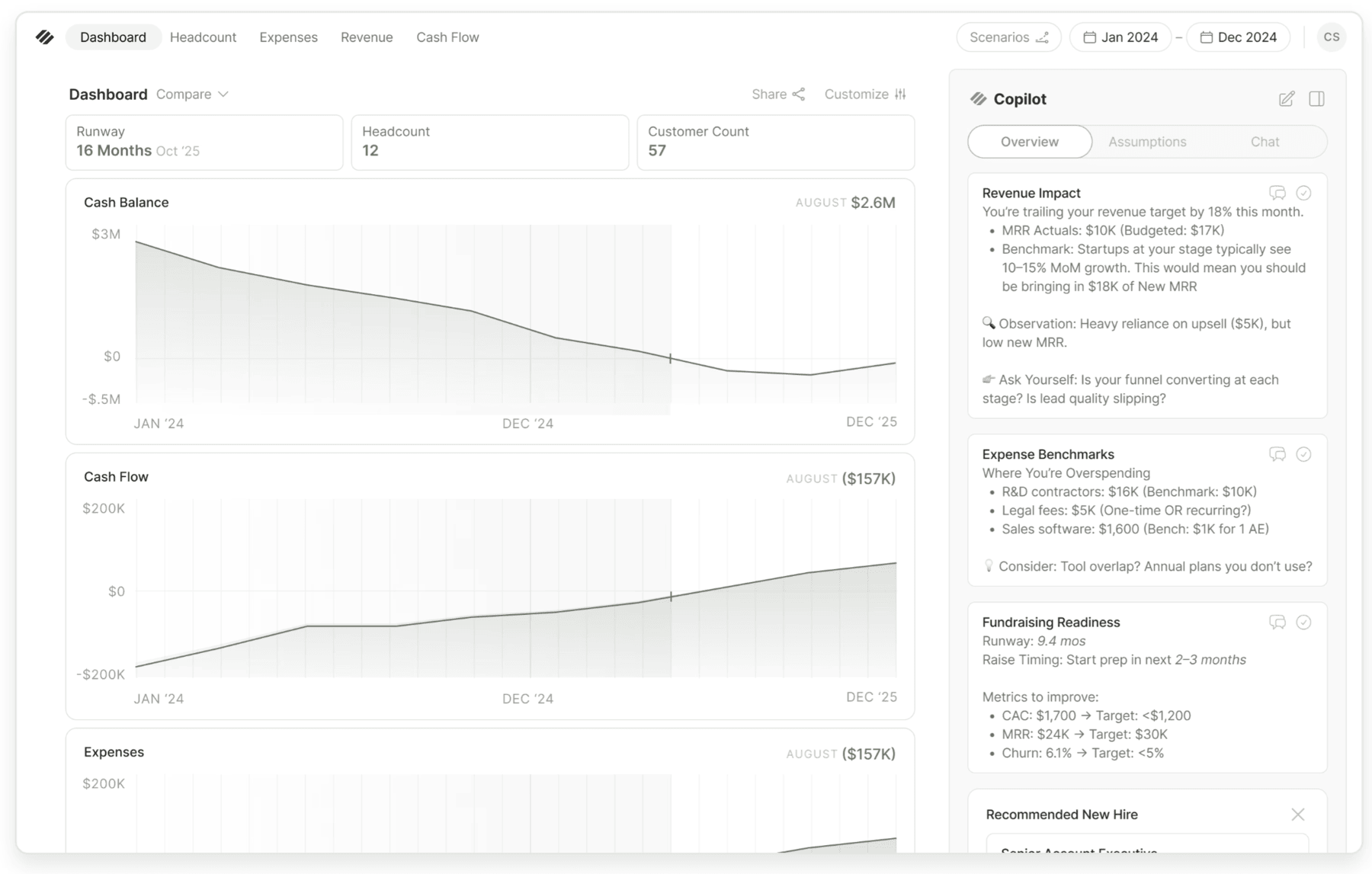

- Always-on models: QuickBooks, Xero, and Puzzle integrations produce live, auditable forecasts in minutes, updating continuously to reflect real-time changes.

- AI finance agents: Autonomous workflows clean and map data, roll models forward, run scenario analyses, explain variances in plain language, and draft board and investor materials.

- Fractional CFO oversight: Expert CFOs validate assumptions, add strategic judgment, and take responsibility for the plan, ensuring actionable and investor-ready financials.

The approach is built to scale. Founder-led teams use Parallel for runway modeling, headcount planning, and investor diligence. Each team starts with a fractional CFO who oversees the initial plan, then continues guiding as internal finance teams are built. With live integrations, audit trails, and role-based access controls, Parallel becomes the FP&A system of record from day one—eliminating the costly switch between tools as the company grows.

Early Results

Startups already using Parallel report faster, more confident decision-making:

- Hyperbound founder Atul Raghunathan: “Due diligence finished without a single follow-up question. What usually takes weeks happened in days, with complete investor confidence.”"Due diligence finished without a single follow‑up financial question,"

- SchoolAI founder Caleb Hicks: “Parallel gave us the clarity and confidence to scale our sales team in line with cash and targets—decisions we would not have made otherwise.”

- Salesdraft founder Ethan Whitehead: “We used to spend hours every week on finance and still had no answers. Now we make decisions in minutes—with ten times the confidence.”

For startups, Parallel’s AI-native approach lets founders focus on product, customers, and scale, while always having CFO-level insight on runway, scenarios, and strategic decisions.

Co-founded in 2023 by Renato Villanueva, (CEO), Tyler Slater (CTO), and Clint Savage (Head of Product), Parallel currently serves B2B SaaS companies from pre-seed through Series A. By pairing AI finance agents with experienced fractional CFOs, the platform transforms finance from a reactive burden into a proactive engine for growth. Parallel is headquartered in Lehi, Utah, at Kiln II.

Learn more at getparallel.com.