Salt Lake City, Utah – October 21, 2025

Appli, the AI-powered financial calculator platform for credit unions and community banks, is marking its first anniversary with a significant milestone: 10 credit union partners and more than $1 billion in lending calculations to date.

Since its launch in October 2024, Appli’s smart calculators have transformed how smaller financial institutions engage members online. The platform reports an average 15% conversion rate, with some credit unions achieving rates as high as 20%, demonstrating that AI-guided tools can turn casual visitors into qualified loan applicants while gathering actionable insights on borrowing behavior.

“We wanted to show that calculators could be more than just math tools—they could guide members to confident financial decisions while giving credit unions early visibility into borrowing demand,” said Tim Pranger, founder and CEO of Appli. “Hitting 10 partners in our first year, with strong conversions across the board, shows credit unions recognize the value of this approach.”

Appli’s growing roster of partners spans the U.S., including First Source Federal Credit Union (NY), Southwest Financial Federal Credit Union (TX), Granite Credit Union (UT), Shoreline Hometown Credit Union (MI), First Northern Credit Union (CA), and InRoads Credit Union (OR). Several more partnerships are expected to be announced in the coming months.

At First Source Federal Credit Union, the calculators have notably attracted non-members searching online for financial tools. “Non-members find our calculators when researching loans online, and because the tools are so intuitive, they don’t just use them—they take the next step and click ‘apply,’” said Katie Ullman, VP of Marketing & Community at First Source. Her institution converts over 15% of interactions into loan applications.

The $1 billion in calculations reflects actual member engagement across auto loans, personal loans, and home equity lines of credit, providing institutions with rich data on borrowing patterns, geographic trends, and preferred loan terms. This intelligence helps credit unions tailor marketing strategies and product offerings with unprecedented precision.

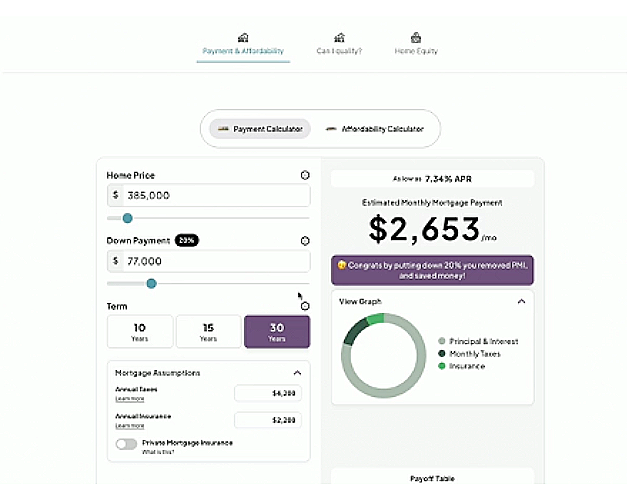

Over its first year, Appli has expanded beyond basic loan calculators, introducing specialized tools such as the Guided Home Equity Calculator, which leverages real-time property valuations to give members a clear picture of their borrowing potential.

The company’s success comes amid a broader trend: community banks and credit unions seeking to enhance digital experiences and compete with larger banks and fintech platforms. Appli’s calculators require just a single line of code and can be fully customized to each institution’s rates, terms, and brand standards, making sophisticated AI tools accessible to financial institutions of all sizes.

“Our first year proved that credit unions are eager to take control of their member intelligence rather than relying solely on third-party lead services,” Pranger added. “When you know what members are looking for before they apply, you can serve them—and your community—more effectively.”

Founded in 2024 by POPi/o co-founder Tim Pranger, Appli provides AI-powered financial calculators that create personalized, engaging experiences for credit union members. Combining real-time data with generative AI, Appli’s tools boost consumer confidence and increase conversion rates for financial institutions. POPi/o was acquired by Eltropy in June, 2022.

Learn more at hiappli.com.