Salt Lake City, Utah - February 5, 2026

This week the 4th FinTech Xchange kicked off at the downtown Hilton as the first major fintech event of 2026, drawing 400 industry leaders, executives, academics, and regulators eager to explore the technological, economic, and regulatory forces reshaping financial services. This year’s program highlighted new research, exclusive content, and rich networking opportunities, offering a comprehensive look at the trends, challenges, and innovations driving fintech forward.

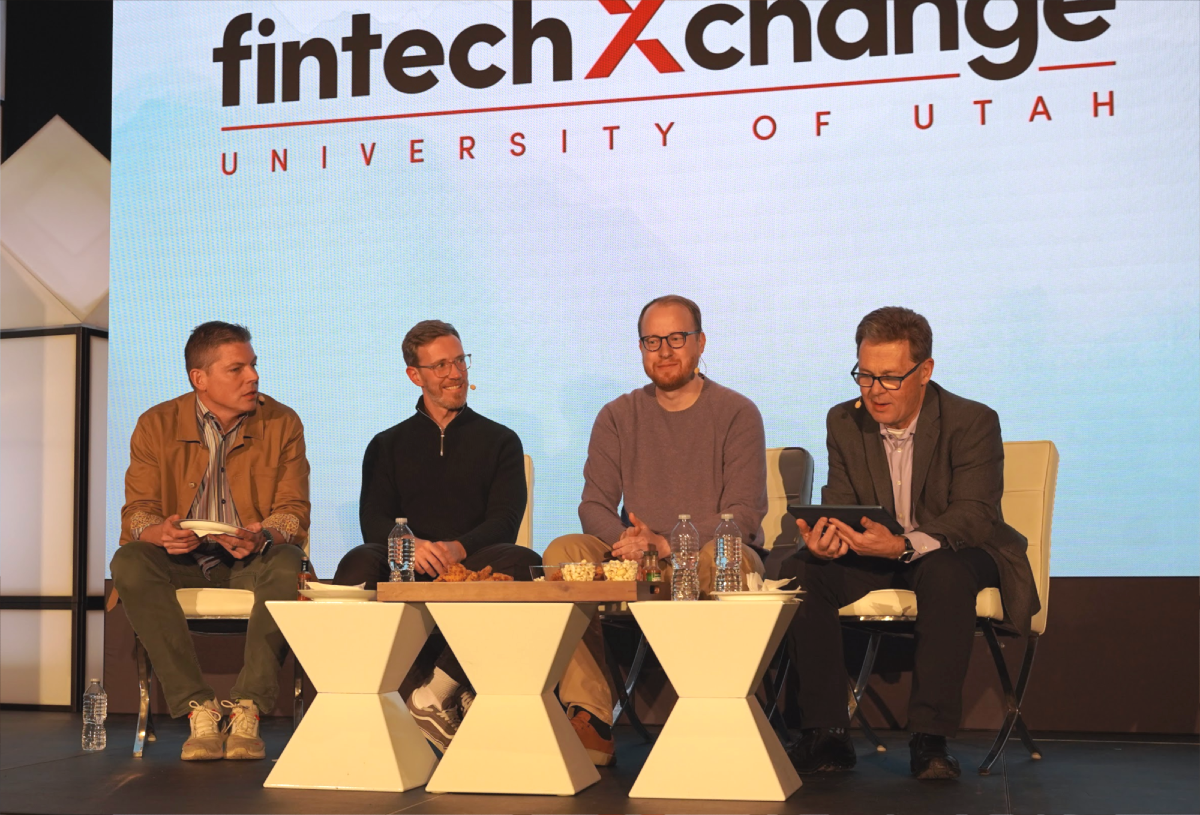

The affectionately dubbed “Hot Takes” panel was a turbocharged conversation maintaining a lively, snack-fueled energy that matched the rapid-fire insights of four of fintech’s most dynamic voices:

Jason Henrichs, CEO of Alloy Labs (Minneapolis), and the mastermind behind a consortium of community and midsize banks making innovation happen through startup partnerships and strategic investments. He’s also co-host of Breaking Banks, the world’s largest fintech podcast, and a frequent speaker on how regulation and compliance can be wielded as a competitive weapon.

Simon Taylor creator of Fintech Brainfood (London) and market development lead at Tempo, spent 20 years riding the waves of fintech change, from mobile to cloud to stablecoins and agentic commerce. Previously, he spent three+ years at Barclays in blockchain research and mobile delivery roles.

Alex Johnson, the Bozeman-based founder of Fintech Takes, brought his razor-sharp analysis and signature pop culture flair to the panel.

Peter Renton, CEO of Renton & Co., is a Denver-based fintech media veteran who’s been producing groundbreaking content, podcasts, and events since the early days of the industry—basically a walking fintech encyclopedia.

Together, the panelists delivered a session buzzing with energy, candor, wit, and insights that kept the audience leaning in and frequently laughing with them.

AI in Financial Services: Middle and Back Office Dominate

The panel’s first hot take smashed through AI hype. Simon Taylor pointed out that while everyone’s obsessing over AI agents running consumer transactions, the real wins are happening in the middle and back office. Compliance, AML monitoring, accounts payable—these are the spaces where AI agents are quietly taking over, saving banks from human headaches and false positives. Henrichs added that this is a seismic shift: operational efficiency redefined, costs slashed, and potential unleashed in ways flashy apps can’t touch.

Regulators Are Ahead of the Curve

Next, the panel flipped expectations about regulators on their head. Far from trailing behind, regulators are using AI to sift through noise and focus on what really matters. Johnson likened it to the evolution of elevator operators: initially indispensable, then redundant as the technology proved safe. The hot take? Regulatory friction might actually shrink faster than anyone expects, letting innovation flourish without getting tangled in red tape.

Stablecoins: Utility Beats Speculation

When it came to stablecoins, Renton and Taylor weren’t pulling punches. Forget consumer hype—what matters is real-world corporate utility. These digital assets are quietly becoming 24/7, cross-border settlement rails, streamlining operations and boosting revenue. They discussed how stablecoins allow fintechs and banks to process transactions faster and cheaper than traditional correspondent banking systems, especially for cross-border payments and corporate treasury operations. Taylor noted that stablecoins can integrate with existing banking infrastructure using ISO 20022 messaging, eliminating the need for costly core system overhauls.

The panelists also emphasized that while some in the media continue to focus on yield and speculative opportunities, the durable impact is operational: stablecoins are a reliable rail that reduces friction and improves liquidity management. For fintech programs, this means enhanced customer experiences and potential revenue without destabilizing traditional banking relationships. Henrichs added a forward-looking perspective, suggesting that as adoption grows, stablecoins could quietly become the backbone of financial programs, invisible to consumers but transformative behind the scenes. The overarching hot take: stablecoins are not about headline-grabbing speculation—they’re about creating infrastructure that actually works, efficiently and continuously, 24/7.

Combating Financial Nihilism

One of the panel's most powerful hot takes addressed financial nihilism: the creeping despair that stops people from saving, investing wisely, or even engaging with their finances. Johnson described it vividly: “When people give up, they start spending more on their credit cards, investing in riskier assets, and even working less hard at their jobs. That’s not just bad for them—it’s bad for our society and economy.” Henrichs added, “We have to think about who fintech is for. There are companies making a profit because people give up. That’s not the side we should be on.”

The panelists shared actionable approaches. “AI can help people set goals, save automatically, and get nudged in the right direction,” Johnson said. He highlighted behavioral tools like defaulting users into savings programs, offering notifications at optimal times, and even features like gambling-blocks to prevent destructive spending habits. “It’s not hard technology—it’s about knowing what to do and making it frictionless for the user,” Henrichs noted. Taylor emphasized that fintech has a moral and strategic choice: “We can either exploit despair for profit or help people regain control of their financial lives. If we choose the latter, we unlock better outcomes for everyone.”

The audience responded with visible engagement, nodding and leaning forward as the panelists mapped the intersection of technology, behavior, and ethics in a way that made the abstract consequences of financial nihilism feel urgent and solvable.

Micro-Apps and Data Innovation

Finally, the panel spotlighted the most exciting under-the-radar moves in fintech: micro-apps and data-driven solutions. Small, scrappy teams are building ultra-focused tools that pack a punch in predictive spending markets, AI compliance, and personalized financial guidance. Taylor stressed that these innovations often outpace traditional venture funding, offering early movers the chance to dominate specialized, high-impact niches.

Companies to Watch

In a rapid-fire segment of quick hot takes, the panelists highlighted specific fintech companies poised to make an impact in the next 12 months. Carefull earned a shout-out from Henrichs for its work in protecting elderly consumers and their families with a comprehensive financial safety operating system. Carefull is an AI‑powered financial safety platform headquartered in New York. It builds tools to help banks, credit unions, and wealth advisors protect older adult customers from fraud and financial mistakes.

Simon Taylor spotlighted Polymarket, noting its innovative approach to predictive spending and market data, which could revolutionize how capital markets leverage consumer insights. The overarching message: these companies exemplify the creativity, focus, and operational precision that will define the next wave of fintech winners. Polymarket is a blockchain‑based prediction market platform also headquartered in New York. It enables users to trade on event outcomes using USDC and has grown into one of the larger prediction markets globally.

The session ended with a rallying cry: fintech’s next wave rewards energy, execution, and integrity over hype. AI, stablecoins, micro-apps, and financial wellness tools are rewriting the rules—but only for those willing to deliver real-world impact.

See more details about the event, its panelists and sponsors at the 4th annual fintech.utah.edu/xchange/.

Sponsors of the event include: University of Utah, LoanPro, Mayer Brown, America First Credit Union, Celtic Bank, First Electronic Bank, US Bank, Merrick Bank, MX, Stripe, Cooley, FinWise Bank, KPMG, Spring and others.